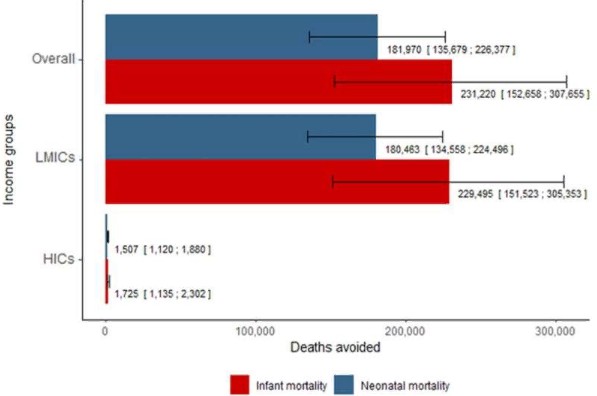

According to the first worldwide analysis of its kind, roughly 182,000 neonatal deaths may have been avoided in 2018 if all countries’ cigarette taxes had followed the World Health Organization’s guidelines.

Tobacco use can have both direct and indirect health consequences for children. Smoking during pregnancy, for example, can result in premature birth, and second-hand smoke can cause lung disorders such as asthma.

According to research done by Imperial College London and Erasmus MC and published in PLOS Global Public Health, rising cigarette taxes could have prevented over 231,000 deaths of children under the age of one year in 2018 (including roughly 182,000 newborns).

Almost 80% of the deaths that may have been avoided would have occurred in low- and middle-income nations (LMICs). According to the researchers, boosting tobacco taxes in LMICs is critical because these countries have the lowest tobacco taxes and the greatest prospects for improving child health.

The WHO advises that tobacco taxes account for more than 75% of the retail price, but only 14% of the world’s population lived in countries that had achieved this in 2018.

Dr. Anthony Laverty, co-lead author of the study and a professor at Imperial College’s School of Public Health, says: “Tobacco usage has a wide range of negative consequences for children’s health. When kids are exposed to second-hand smoke in the womb or in the home after birth, they are more likely to have health problems later in life, such as premature delivery and asthma.

Tobacco use can also cause serious health problems for smokers’ parents, hurting their capacity to earn a living and their family’s finances, which can have an indirect impact on a child’s health. To combat all of these causes, as well as the hundreds of thousands of unnecessary infant deaths we estimate are linked to smoking, strong global tobacco control is critical.”

Dr. Filippos Filippidis, a senior study author from Imperial College’s School of Public Health, says: “Raising tobacco prices has been proven to be the most effective way to reduce smoking, but most studies have only looked at adults or nations with high incomes.

Increased tobacco taxes have been found to reduce preterm birth rates, asthma exacerbations, and child deaths in high-income countries, but it was unclear whether these findings could be applied to low- and middle-income countries, where there is less awareness of tobacco-related harm and the tobacco industry’s influence is stronger, potentially suppressing the positive effects of raising taxes.”

In 159 low- and middle-income nations and high-income countries, a new study looked at the link between cigarette taxes and neonatal and infant mortality (HICs). It used mortality and tobacco tax data from 2008 to 2018 for each country. The study does not look into particular tobacco-related causes of mortality.

The results were further evaluated based on the sorts of taxes that were used (overall, as well specific types of taxes, such as specific cigarette taxes, value added taxes and import duties). They point out that because their study didn’t look at overall cigarette pricing, it may have missed how tobacco corporations routinely counter these levies by cutting the price of their goods.

Other associated variables such as gross domestic product, fertility rate, education, and availability to drinking water were taken into account by the researchers.

The global neonatal and infant mortality rates were predicted to be 14.4 and 24.9 deaths per 1,000 live births, respectively, between 2008 and 2018. These rates were greater in LMICs than in HICs, with 33 children under the age of one (including 19 newborns) dying each year in LMICs compared to 6 children under the age of one (including 4 newborns) in HICs.

Furthermore, between 2008 and 2018, the average tax on cigarettes in LMICs was lower than in HICs (43 percent and 64 percent tariffs, respectively), and fewer LMICs exceeded the WHO-recommended 75 percent tax threshold in 2018. (11 percent of LMICs vs 42 percent of HICs).

According to the researchers, a 10% rise in tobacco taxes (i.e., a 10% increase in the overall retail price of cigarettes) would result in a 2.6 percent reduction in neonatal deaths worldwide and a 1.9 percent reduction in deaths among children under the age of one year.

In 2018, this would correspond to about 78,000 fatalities of children under the age of one, including 64,000 newborn deaths, over the world.

Increases in all sorts of taxes were linked to improvements for child survival, according to the study.

“Taxes can raise the retail cost of a package of cigarettes, which may lead to people quitting smoking as the habit becomes more expensive,” Dr. Laverty explains.

“Ensuring that children grow up in a smoke-free environment should be a global health and human rights priority,” says Dr. Marta Rado of Erasmus MC Rotterdam, who co-led the study.

The researchers point out that their analysis focused just on cigarette taxes, not other kinds of tobacco, and that they used tax data from each country’s top-selling cigarette brands.

The researchers believe that the relationship between taxation and child fatalities is comparable across nations, but they point out that numerous factors can influence this, including smoking prevalence, illicit tobacco trade, availability of other tobacco products, and each country’s child healthcare programs.