A few months back, a friend of mine decided to invest in Bitcoin for the first time.

He’d read about the Shiba Inu token’s amazing climb earlier that day. The possibility of becoming a millionaire overnight drew him in, as it did anybody else. He’d created an account on Crypto.com, performed the Know Your Customer (KYC) procedures, and purchased 1.5 million Shiba Inu coins by midday.

Singapore is one of a select few countries where purchasing cryptocurrency is as simple as it gets.

As of now, nine nations have outright banned cryptocurrency, with China being one of them. Another 42 have limited prohibitions on the use of cryptocurrency.

Simultaneously, there are a large number of countries that are currently in limbo. Russia and India, for example, are both pursuing legislation that is hostile to blockchain technology.

What is the purpose of cryptocurrency regulation?

To put it another way, regulating cryptocurrency is a balance issue. It’s a question of balancing the benefits of innovation against the dangers of financial instability and crime.

Singapore has a lot to gain on the other end of the spectrum, with China trending far right. The country has become a crypto hotspot in Asia over the last few years, thanks in large part to the freedom that enterprises have had while experimenting with blockchain technology.

It also helps that Singapore has maintained a consistent policy on cryptocurrency. The Monetary Authority of Singapore (MAS) has acknowledged the potential benefits of blockchain technology, as well as the risks, even in times of high volatility and heavy speculation.

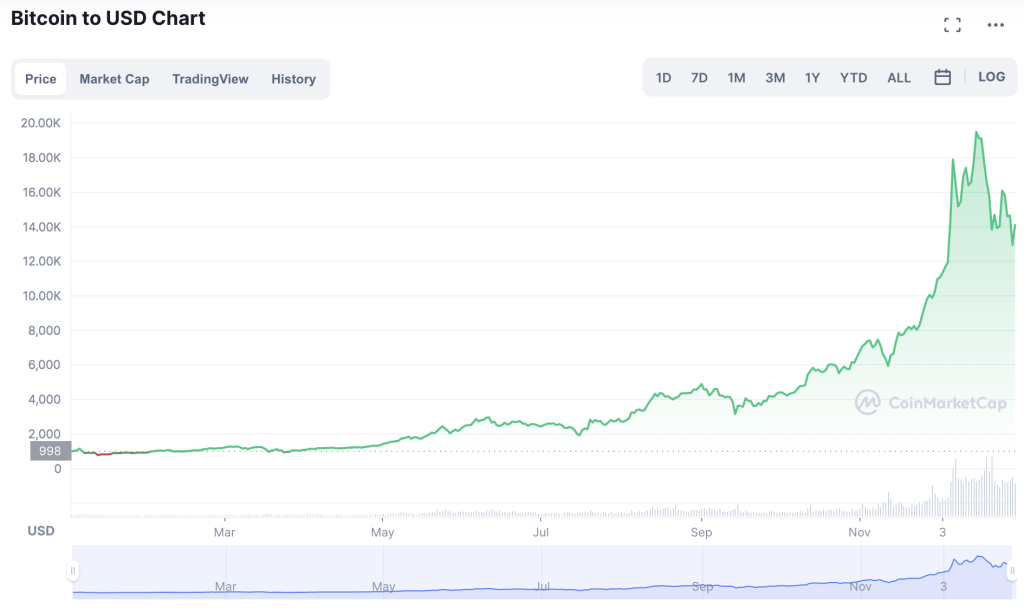

Bitcoin soared from US$1,000 to just under US$20,000 in value in 2017

Consider the year 2017. Following Bitcoin’s historic run this year, China has prohibited financial institutions from assisting cryptocurrency transactions. Meanwhile, Egypt proclaimed cryptocurrency to be an unlawful currency on its whole.

These judgments may have rescued retail customers from dangerous investments, but they did so at the expense of innovation.

MAS, on the other hand, just issued warnings, as it has done for the past many years. Because of the volatile value of cryptocurrencies, retail investors are urged not to treat them as investment assets. They were not, however, forbidden from investing if they so desired.

While operating in Singapore, blockchain companies have had similar freedoms, including the ability to continue operations while the MAS considers a course of action. Even today, these businesses are allowed to operate under an exemption while they pursue a Payment Services Act license.

Why did Singapore issue crypto licenses in the first place?

Singapore has not enacted any new legislation to regulate cryptocurrency.

Rather, the MAS is enforcing existing securities rules to regulate the space. This is due to the fact that some digital tokens are now being utilized in the same way that traditional securities like stocks and mutual funds are.

The MAS can maintain the baseline quality of safety and protection for retail investors by grouping traditional and digital securities together.

Crypto exchanges will be required to keep a certain level of capital and have the resources to secure assets under this standard. These clauses, along with a long number of others, can help prevent some of the current scams in the crypto field.

Is Singapore becoming less crypto-friendly as a result of this?

It all depends on your perspective. On the one hand, these rules make it more difficult to start a company that deals in digital securities.

The MAS had withdrawn or rejected over 100 of these businesses’ applications (out of 176) according to a report from December 2021.

Binance, the world’s largest cryptocurrency exchange by daily trading volume, was one of these firms. The exit of Binance from Singapore sparked speculation that the country is no longer the crypto refuge it once was.

But this isn’t always the case. It appears that Singapore has become more hostile to cryptocurrency-related frauds and scams, rather than to cryptocurrency itself. The Securities Regulations are only used when they are absolutely necessary. Exchanges that do not plan to engage in digital securities can continue to operate as usual.

To be clear, digital securities are crypto tokens that indicate ownership in an underlying asset or that can be used to claim the debt.

This excludes the most well-known cryptocurrencies, such as Bitcoin and Ethereum. In its attempt to control a sector of the crypto space, the MAS has taken care not to impede the crypto space as a whole.

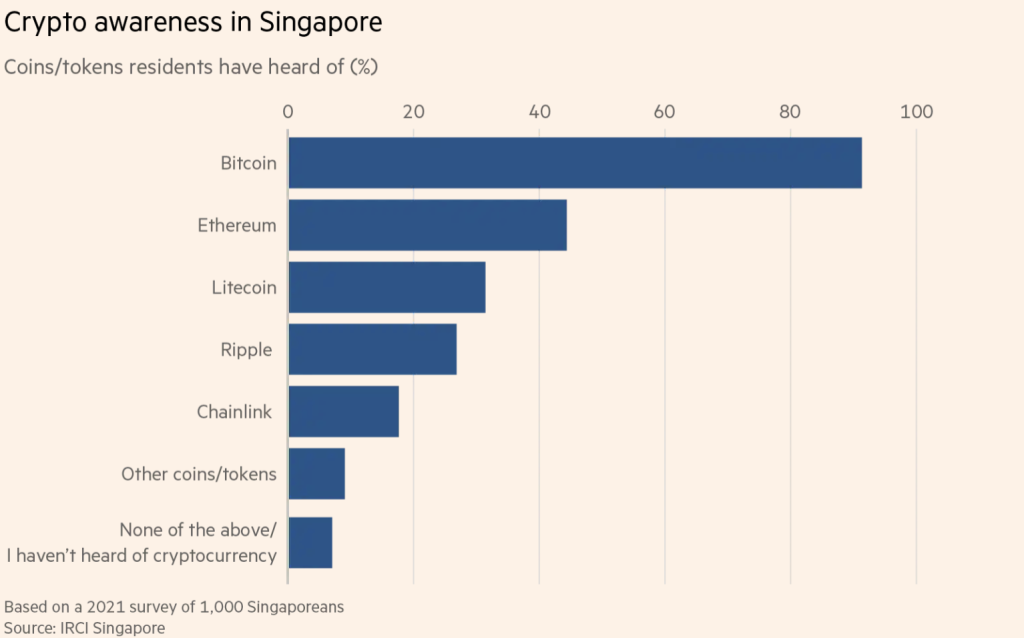

Over 90 per cent of survey respondents had heard of Bitcoin in 2021

From the standpoint of a retail investor, Singapore remains as crypto-friendly as it has always been. It’s really simple to set up a wallet, buy coins, and gain access to everything the blockchain has to offer.

Apps like Crypto.com even have their own debit cards that may be used on a daily basis. Users may earn bitcoin cashback and instantly change between crypto and fiat currency.

These new restrictions may even encourage more people and businesses to adopt cryptocurrency. They’ll be able to diversify their savings without fear now that their concerns about investment safety have been addressed.

![[review] We Break Down Why Huawei P50 Pocket Won’t End Samsung Galaxy Z Flip 3’s Career Yet](http://thetidings.org/wp-content/uploads/2022-02-05-145013-180x101.jpg)

There are some fascinating cut-off dates on this article but I don抰 know if I see all of them center to heart. There is some validity but I will take hold opinion until I look into it further. Good article , thanks and we would like extra! Added to FeedBurner as effectively

you’ve an ideal weblog here! would you like to make some invite posts on my blog?

Aw, this was a very nice post. In thought I wish to put in writing like this additionally ?taking time and actual effort to make an excellent article?however what can I say?I procrastinate alot and by no means appear to get one thing done.

This website online is really a walk-by for the entire data you needed about this and didn抰 know who to ask. Glimpse right here, and also you抣l undoubtedly discover it.

canadian pharmacies selling viagra https://canadadrugs.pro/# – canadian prescription canadadrugs.pro

list of canadian pharmacies https://canadadrugs.pro/# – canadian pharcharmy canadadrugs.pro

prescription drugs without prior prescription https://edwithoutdoctorprescription.pro/ buy prescription drugs

mexican online pharmacies prescription drugs https://certifiedpharmacymexico.pro/ best online pharmacies in mexico

cipro generic https://cipro.guru/ buy ciprofloxacin over the counter

ciprofloxacin generic price https://cipro.guru/ cipro pharmacy

ciprofloxacin generic https://cipro.guru/ ciprofloxacin 500mg buy online

buy ciprofloxacin over the counter https://cipro.guru/ antibiotics cipro

buy ciprofloxacin over the counter https://cipro.guru/ cipro generic

ciprofloxacin generic price https://cipro.guru/ ciprofloxacin 500mg buy online

diflucan 200 mg over the counter https://diflucan.pro/ diflucan pill otc

https://doxycycline.auction/

Sweetie Fox filmleri https://sweetiefox.online/ – swetie fox

Sweetie Fox https://sweetiefox.online/ – Sweetie Fox modeli

Sweetie Fox https://sweetiefox.online/ – sweeti fox

abella danger video https://abelladanger.online/ abella danger izle

abella danger izle https://abelladanger.online/ Abella Danger

b3800m sweetie fox cosplay https://sweetiefox.pro/ – fox sweetie

mASGbp fox sweetie https://sweetiefox.pro/ – sweetie fox video

Iu35Pu fox sweetie https://sweetiefox.pro/ – sweetie fox full video

mia malkova hd: https://miamalkova.life/ mia malkova only fans

mia malkova only fans: https://miamalkova.life/ mia malkova full video

mia malkova new video: https://miamalkova.life/ mia malkova

aviator sinyal hilesi: https://aviatoroyunu.pro pin up aviator

jogo de aposta – https://jogodeaposta.fun/ aviator jogo de aposta

melhor jogo de aposta para ganhar dinheiro – https://jogodeaposta.fun/ melhor jogo de aposta para ganhar dinheiro

play aviator https://aviatormalawi.online – aviator bet malawi login

aviator malawi https://aviatormalawi.online – aviator bet

aviator login: https://aviatorghana.pro/ aviator sportybet ghana

aviator betting game: https://aviatorghana.pro/ aviator betting game

pin-up cassino https://pinupcassino.pro/ pin-up casino login

pin-up cassino https://pinupcassino.pro/ pin-up casino

pin up https://pinupcassino.pro/ aviator oficial pin up

aviator betting game https://aviatormalawi.online – aviator bet

site de apostas – https://jogodeaposta.fun/ jogo de aposta online

aviator jogo de aposta – https://jogodeaposta.fun/ melhor jogo de aposta

aviator mz https://aviatormocambique.site aviator moçambique

aviator online https://aviatormocambique.site como jogar aviator em moçambique

aviator https://aviatormocambique.site aviator

aviator online https://aviatormocambique.site aviator bet

aviator oyna slot: https://aviatoroyunu.pro aviator

sweet bonanza bahis https://sweetbonanza.bid/ – sweet bonanza 90 tl

en çok kazandiran slot siteleri https://slotsiteleri.guru/ deneme bonusu veren slot siteleri

aviator https://aviatoroyna.bid – aviator uçak oyunu

aviator bahis https://aviatoroyna.bid – aviator oyunu 20 tl

aviator oyunu https://aviatoroyna.bid – aviator hilesi ücretsiz

aviator oyunu 10 tl https://aviatoroyna.bid – uçak oyunu bahis aviator

india online pharmacy: best online pharmacy india india pharmacy indianpharmacy.icu

india online pharmacy: world pharmacy india indianpharmacy com indianpharmacy.icu

indian pharmacy: indian pharmacies safe indian pharmacies safe indianpharmacy.icu

best online pharmacy india: buy medicines online in india indian pharmacy paypal indianpharmacy.icu

indian pharmacies safe: indianpharmacy com reputable indian pharmacies indianpharmacy.icu

india online pharmacy: best india pharmacy indian pharmacy indianpharmacy.icu

reputable indian online pharmacy: canadian pharmacy india top online pharmacy india indianpharmacy.icu

online pharmacy india: indian pharmacy paypal online pharmacy india indianpharmacy.icu

buy medicines online in india https://indianpharmacy.icu/# – indian pharmacy online indianpharm24.shop

best mexican online pharmacies https://mexicanpharmacy.shop/# purple pharmacy mexico price list mexicanpharmacy.shop

mexican border pharmacies shipping to usa https://mexicanpharmacy.shop/# mexican rx online mexicanpharmacy.shop

purple pharmacy mexico price list: mexican online pharmacies prescription drugs best online pharmacies in mexico mexicanpharmacy.shop

legitimate canadian mail order pharmacy: canadian pharmacy online best canadian online pharmacy reviews canadianpharmacy24.store

online canadian drugstore: canada rx pharmacy canadian pharmacy near me canadianpharmacy24.store

canada pharmacy 24h: best rated canadian pharmacy canadapharmacyonline legit canadianpharmacy24.store

reputable canadian pharmacy: canadian pharmacy oxycodone canadian pharmacy 365 canadianpharmacy24.store

cheapest pharmacy canada: canadianpharmacymeds com canadian pharmacy 1 internet online drugstore canadianpharmacy24.store

reliable canadian pharmacy: canada pharmacy reviews canadadrugpharmacy com canadianpharmacy24.store

online pharmacy canada http://canadianpharmacy24.store/# – best canadian pharmacy to order from canadianpharmacy24.store

game cờ bạc online uy tín http://casinvietnam.shop/# – casino trực tuyến việt nam

casino trực tuyến việt nam https://casinvietnam.shop/# – chơi casino trực tuyến trên điện thoại

casino trực tuyến uy tín https://casinvietnam.com/# – casino online uy tín

casino trực tuyến uy tín https://casinvietnam.com/# – casino trực tuyến uy tín

tamoxifen adverse effects https://nolvadex.life/ tamoxifen joint pain

buying propecia price https://finasteride.store/ order generic propecia without dr prescription

get generic propecia price https://finasteride.store/ buy cheap propecia

buying generic propecia without insurance https://finasteride.store/ buy propecia without dr prescription

cost of generic propecia for sale https://finasteride.store/ cost of generic propecia

cipro online no prescription in the usa https://ciprofloxacin.tech/ ciprofloxacin generic

purchase cipro https://ciprofloxacin.tech/ purchase cipro